Personal Finance: Breaking Down a Family Budget

I typically focus most of my efforts and time on investments and want to find more time to write educational and insightful blogs on that topic, but first wanted to start with a topic that hits home with everyone. There have probably been thousands of articles on the topic but as is my goal with any piece of reading, including a 400+ page book, as long as I come away with one new piece of information that adds value, it is worth the read, so that is what I am hoping to do here.

We have all seen, and laughed at, the budget articles on CNBC and other major media outlets that have outlandish numbers for many of the components. In my example below I am providing the major elements of my personal spending which will of course differ from person to person but should touch on all the major things. After doing this exercise I was shocked at how much money outflow I have annually and left me reassessing how an average family really does it these days. Although we see the headline inflation numbers muted, the prices of most everything an average family is buying has been increasing steadily. Recently this year in a survey we saw that 60% of Americans cannot afford a $500 emergency expense, which blew my mind, but after putting this together it all made sense, as did the amount of credit card debt. Financial issues are a top cause of anxiety and a major cause of relationship problems, so I imagine a lot of people out there are hurting despite a stock market at new highs, the average American really does not seem to be participating in the past decade of wealth generation and if another Recession were to hit anywhere near the magnitude of the most recent one, I imagine it will be absolutely devastating.

First, I am very fortunate to own a large house, a lot of property and live in a fairly wealthy area, Bucks County, PA. My budget also reflects having two kids, 3 years old and 9 months old. Second, I never really hold back with spending money preferring to purchase high quality things that will last longer, but I also am not a lavish spender by any means and these numbers I provide are fairly conservative. For example, nowhere in this budget will be a slow Sunday like today where we went to the fishing store to get licenses, a couple lures, grabbed lunch at the Italian market, and then went to the park (free) but if chose to swim it would have been a $45 fee added on, the other items amounted to around $125. These kind of days likely happen at minimum twice a month so that would be $3000 unaccounted for alone. Last week I had to do a driver license renewal for the Real ID program that ran a random $65 or something. There are so many spontaneous expenses/costs that are also not budgeted for, a few examples this year for me alone include a Dishwasher ($1000), Shutters ($1000), a Viking Axe & Shield ($960), catered birthday party for my daughter ($1700), Truck needed new AC/Exhaust ($100), new security system upgrade for the house ($500), Golf Clubs ($1300), and Game 7 Stanley Cup Ticket ($2100). We are talking over $8000 in random things halfway through the year. I also did not include a few things like my wife’s YMCA membership, kid’s classes (music, swimming, etc.), EZPASS and likely left out others that pop up annually. I also have no costs on here for clothing as I never buy clothes unless it is a brewery shirt and my wife is not a big shopper either, but I imagine it could be a major expense for others.

Third, there are likely a lot of costs I do not have that other living styles may, and vice versa, this is by no means perfect. Lastly, one can clearly see the cost of home ownership, not even counting a mortgage that likely cancels out with a renter’s rental cost, things like utilities, home repair, home upgrades, mower/HVAC/generator servicing, pool fees, landscaping costs, home security, and other things really add up. This past week or fridge started jumping in temperature randomly and may require a repair, stuff like this happens every single month if you own a home.

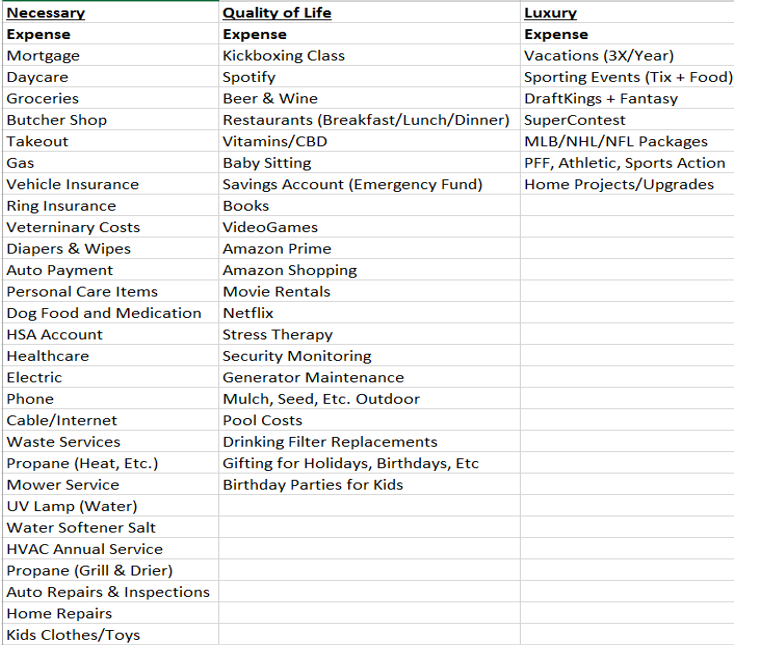

Now, for the process I felt it is best to break this up into “Necessary”, “Quality of Life”, “Luxury” and for me, also a column for “Business Expenses.” I am going to provide a screenshot from my Excel Sheet of each of the categories as well as the total and monthly costs. I am not going to show the cost of each item for privacy reasons but believe me they are conservative and not excessive. I will discuss a few things in each category as well and give some ballpark numbers of things that are less private.

Starting with the “Necessary” group my monthly expenditures come to $8,800 for around $105,000 per year. Our mortgage and daycare costs alone are above $50,000/year and Food hits $12,000-$15,000 annually, basic things every family is paying. Our gas costs are very low because my wife works 3 days per week and I work from home. Everyone knows the exorbitant cost of Healthcare and I also contribute the max to the HSA each year due to the tax advantages. Auto costs tend to add up quickly with basic things like annual inspection, registration and then big items like brakes, tires, etc. tend to hit at least once a year for one or both of the vehicles. The rest are basic utilities and the costs of having kids & pets. We live a low-key lifestyle, heck I still drive my 2007 Nissan Titan.

Onto “Quality of Life” which I feel are fairly basis and not exorbitant expenses by any means, and this group comes to $2,660/month or $32,000 per year. Combining with the prior category we are already at $137,000/year, so someone with a 35% tax rate would need to earn over $200,000/year just to cover these costs, roughly (not calculating deductions, etc.).

In the “Luxury” category everyone will have different things. The category for me came to $3,460/month or $41,500 per year. We try and take 2 or 3 longer vacations per years with average around $5000/each when adding in flight, lodging, food, pet sitting, airport parking and all the other things that add up. This does not even include the multiple 3 to 5 day mini getaways we like to have each year which are not as costly but more costly than staying at home. I put in around $4000/year to fantasy/betting on sports though I tend to get more back in return. The home projects & upgrades inflates these numbers a bit because I have been in this house six years and some of my projects already include Hardwood Floors for Office and Living Room ($14,000), Whole House Generator and 500 Gallon Propane Tank ($15,000), Garage Makeover & New Doors ($20,000), Custom Trex Deck ($52,000), Kitchen Re-Model ($40,000), Pool Cover and Motor ($3,000), Upstairs Carpeting ($7,000), New AC Unit and Water Heater ($15,000), and then plenty of $500-$1000 minor projects like crown molding, painting, RO System, window treatment, fire pit, and this does not even count furniture expenditures. The big projects alone here run $176,000 over 6 years, or $29,000/year. The good news is I think I am almost done outside of a new fence, concrete staining, and master bathroom remodel. Also, I did a lot of the work myself of a number of these projects that make the number lower than it should be for other people.

And, for someone like me, owning your own business comes with plenty of expenses. My annual business estimated expenses I came to was $91,280/year or $7,600/month and that is likely conservative. This does not include my “salary” either just the salary/bonus for my employee, various financial tools I pay for, accountants, web costs, payroll, merchant fees, and various other fees.

Adding these up, my annual expenses come to $270,000 per year, $180,000 ex-business costs, and as previously mentioned that likely misses capturing a number of other things, yes I almost threw up as I completed this spreadsheet. I am not a big spender and not someone that ever shops, especially for myself. Most of the money I spend goes to high-end food & beer, and experiences like travel, things I think we can almost all agree are worth the costs. I also live way below by means, so I bought a house that is less than 20% of what I can “afford” according to those home buying models. I have been fortunate to start a very successful business while also generating large investment returns (one account +257.7% over last seven years and the other is +237% over the last five years which compares to the Russell 2000 +48.16% over five years.)

I can no longer laugh at those articles about family’s earnings $200,000/year and struggling, the struggle is real. I imagine there are some major expenses like private education that could even make the numbers larger, and for those families with more than two kids I really have no idea how you do it, and I am not just talking financially. Even someone like me who earns enough to cover expenses and stash away a lot of money into investments the financial stress of just thinking about these numbers is very real, because you never know the sort of changes life can suddenly throw at you, and I really feel for the millions of families that must not just stress about how their portfolio did last week/month/quarter, but more so on how to just cover the necessary monthly expenses while trying to make tough decisions to allocate to some of the quality of life expenses, and most often foregoing any of the so-called luxury expenditures. There are also the factors that do not apply to me that stricken many such as student loan and credit card debt. The latter is something I have not once in my lifetime carried a balance but understand for many that is not an option because, simply, “shit happens.”

I think this process/approach can be helpful for others to clearly lay out what you need to bring in each month to stay above water, and define extra (quality of life and luxury) expenses that can be modified as needed.

Hopefully, in future articles I can provide some insights into how to save better & invest better.

Thanks for Reading

Joe Kunkle

@OptionsHawk

0 Comments