Options Flow and Earnings: Being Selective & Finding Big Winners that Fit the Formula

You often hear during earnings season that putting on options positions for earnings reports is like playing roulette, implying a low probability of winning. You also often hear a lot of people who do not hold stock/option positions through earnings which has never made a lot of sense to me considering a large portion of a stock’s move through the course of a year takes place via earnings moves. Like most blanket statements, none of this is true, and it simply goes back to putting in the work and developing, and then refining, a plan. If you are just going to pick names that look good on the chart or are popular you likely will not make money, but if you combine a number of research techniques you can really gain an edge and improve your probability of success. It is becoming even more important as earnings moves continue to become bigger across the market and accounting for more of the annual returns than any other time in history.

Goldman Sachs did a robust study recently that can also help us noting the best entry/exit points around earnings for fundamental managers assessing single stock liquidity. The data suggested the five days preceding earnings are ideal for entries, and to wait 4-6 days after earnings to exit. In July 2018 they analyzed 35,000 earnings events over 20 years to identify the most valuable indicators for predicting a stock’s direction on earnings day while sifting through 100 variables. It concluded that stocks with high implied moves are more likely to trade up on earnings as investors fear volatility and wait to buy stocks after the vent, high short interest stocks trade down more often on earnings as fundamental investors are correctly positioned for weak fundamentals, high price targets raise the probability of trading up on earnings, and high revenue/EPS growth stocks tend to trade higher on earnings day. You can also see below that the stock’s recent performance/volume and skew provide little insight which I have also discovered while developing my earnings formula.

Furthermore, buying calls ahead of earnings five days prior and selling the day after has historically consistently outperformed buying puts or volatility strategies.

The data also showed knowing with perfect fundamental insight the EPS results for the quarter one would still only get the stock direction correct 55% of the time which suggests the market has a complex reaction function well beyond beat/miss. The study also indicated earnings events are often mean reverting, showing a strong contrarian indication with the stock return in the weeks/months leading into earnings versus the earnings day move direction. However, this shifted in 2015 and in recent years as momentum strategies have become increasingly crowded.

Now I do not have the resources of Goldman Sachs to provide you with such a comprehensive study but I am one that has followed earnings every single days for 10+ years and feel I have developed a great understanding for both predicting earnings day moves and the reaction.

The factors I look for in the OptionsHawk Earnings Formula for bullish moves re as follows:

- Strong YTD trend trading above the 200 day MA and showing basic relative strength to industry peers. I prefer a name in a multi-week consolidation just below a key resistance breakout point that is within reach of the earnings implied move. The consolidating names have tended to work best compared to names that make very strong moves the days preceding the report where expectations are clearly getting elevated.

- Strong fundamentals with EPS/Revenue growth exceeding the market & peers, healthy margin trends, and a bonus if peer reports have already provided a positive read-through for industry demand.

- Earnings History – I tend to look at the last six quarters at minimum and seeing the average historical close and max move. This is an easy way to tell how well management conveys the message on its earnings calls and also tends to align with the fundamental momentum of a company.

- Short Interest: I prefer lower short % float names, but if a higher short % float name checks the other boxes and is showing Q/Q decline in short ownership and/or at the lower end of a multi-year percentile for short interest, exceptions can be made.

- Options Positioning: The OptionsHawk database has all the info needed for determining the size of positioning in the options market and details the strike price and month which enables you to develop an expected move and timeframe view. I want to focus on names that have seen multiple days of bullish activity, call buys and/or put sales, across multiple expirations. We also want to focus more on activity that was done more than 3 days in advance of earnings as a lot of the activity in the days into earnings can be discounted as hedging/protective and also gives less quality signals as it is often being done by the retail crowd. Also, you want to be putting on positions more in advance to avoid paying the higher IV premiums.

These same methods can be applied simply using the inverse of these conditions when looking for short stock & long put positions for names into earnings.

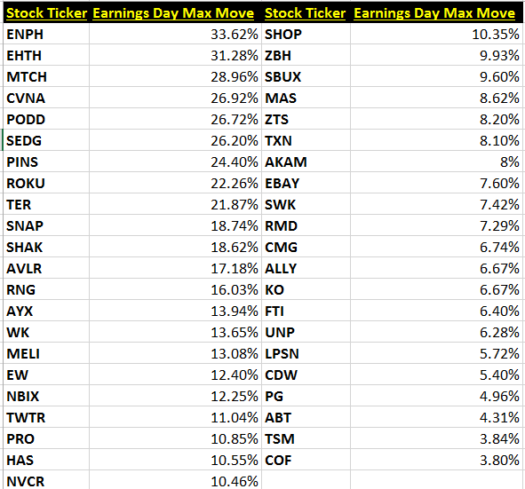

A few examples that fit the formula this past quarter are shown below, a number of major winners and definitely leaving some out, and also a few failures this quarter which any strategy will have, such as Netflix (NFLX), Zillow (Z), and CSX Corp (CSX). The names shown below were consolidating with relative strength to peers, were not seeing a strong rise in short interest, had solid earnings histories with strong fundamentals, and attracted bullish options positioning well in advance of the earnings date that remained in open interest. There were a number of nice hits on the short side as well like Align (ALGN), I-Robot (IRBT), and Tupperware.

I’ve previously also written on the importance of knowing options positioning for trading names after reporting as well where there are an abundance of opportunities after the initial reaction. Combining this with some of my new work using VPOC levels has taken that to the next level.

That’s all for now, I hope you enjoyed the read!

Joe

0 Comments