A New OptionsHawk Product You Will Love, and Illumina (ILMN) is the Perfect Example

I have been working on a new product idea that I think will be a major game-changer and appeal to both active and inactive investors wanting to stay better informed about the stocks they own, or want to own. I have not come up with a name for it yet or a price point but hoping to have it in testing later this year.

The idea is users will be able to set-up a portfolio/watchlist of say up to 100 stocks and will be live alerted by email, text, tweet (option to select method) anytime one of the user’s stocks is mentioned in our living Trading Hub, via an API. We cover the markets live every day and typically cover hundreds of stocks daily from different perspectives. We also will allow an option for which category of alerts a user wants to receive. I also think an end of day recap email auto-generated of your alerts will be useful.

Some of the things that would be alerted for stocks:

- Options Activity – Anytime we highlight options activity in the name you can receive an alert, keeping you informed of smart money positioning, and potentially impacting your strategy. If we highlight large over-writes in a name you own, perhaps you want to follow along. If we see some large put buys in a name you own that remains in healthy technical shape, you may want to hedge off some risk as well. If we highlight strong bullish activity you may want to add to your position, or if a watchlist name, start a new position. The opportunities and signals are endless.

- Analyst Notes – We cover all the daily upgrades, downgrades, and other analyst mentions for stocks, as well as providing some of the color from the note most of the time. If one of your stocks is mentioned in an Analyst piece you can be alerted.

- Stock-Specific News – This can range from M&A, Buybacks, Dividends, Product News, Rumors, Media Coverage, etc. which we capture the large majority of on a daily basis

- Earnings – Get alerts when your stocks post results and on hundreds of names each quarter we pull out the key details from the report, and often peruse transcripts for valuable information nuggets.

- Technical – Get alerts when we cover a stock with technical analysis, whether a simple resistance breakout alert, support breakdown, or a more detailed chart view and analysis.

- Fundamental/Other – We often dive into names and provide fundamental insights and a lot of other research

- Institutional & Insider – Be alerted when there is Insider Buying activity in one of your stocks, and notable Institutional portfolio changes from our curated list of top funds

- Other – I am sure I am forgetting things we notate daily.

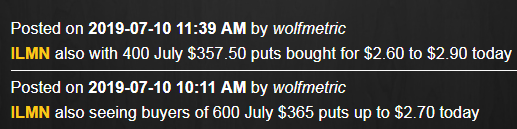

I am posting this now because Illumina (ILMN) trading down 20% after-hours after lowering its guidance is a perfect example. ILMN has been a strong performer that past 6 weeks since clearing resistance, but the last two days it saw selling on increased volume while breaking its 8 day MA (important trend level), and July OpEx VPOC. It also was alerted in the Trading Hub for seeing an unusual surge in front-month put buying despite no events scheduled on the calendar (shown below).

Now someone that has ILMN on their portfolio/watchlist that has enjoyed a big run would have received this alert on 7/10 and it likely would make them think, maybe it is time to take profits, or hedge for downside ahead of earnings season. At least this is how I use this type of information. Someone not receiving this alert would have just had 6 weeks of gains wiped out in a single after-hours news on an unexpected catalyst.

On the flip side, you also would have been alerted on ILMN with the bullish flow and the technical alert right when it started making its move in June, shown below:

I realize posting this now means others are likely to try and copy the idea and do the same, but I stopped caring about that, as people have been trying to copy what we do at OptionsHawk for ten years and keep coming up way short, because, simply, we do the research better, faster, and more accurate and our team’s work ethic is unparalleled.

I’m not going to name names but there are all these guys out there now trying to analyze options flow and getting it wrong 50% of the time because they lack the knowledge of how to properly assess trades, or the will to manually analyze each notable trade instead of relying on an automated scanner. And do not get me started on all these automated option scanners popping up, they are terrible and get the flow wrong constantly. That is another area I want to attack down the road because I can create one with the proper in depth programming logic to be faster and more accurate.

Anyways, hopefully this will be something of interest, and any recommendations for it to be even more awesome are welcomed via Twitter replies!

0 Comments