Equity & Options

Market Research, Analysis

& Strategies

is the premier site for active option and equity traders offering real time coverage of markets via options activity alerts, technical set-ups, breaking news, in-depth research and much more.

Set-Ups

Talk

Weekly

market

View

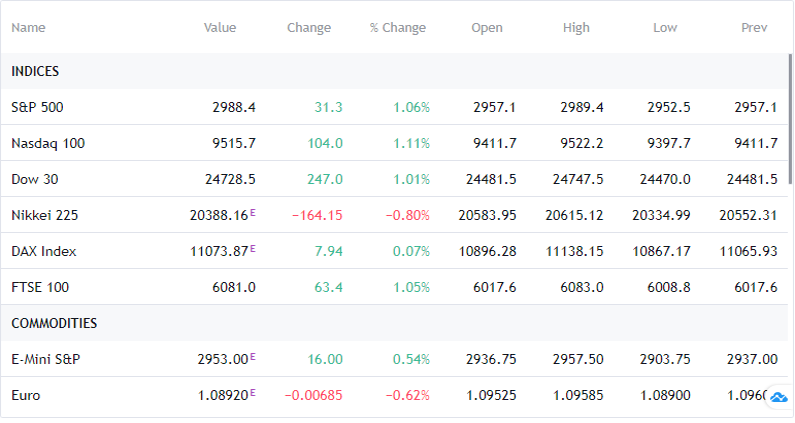

The S&P 500 (SPX) pulled back off the 200-day EMA and YTD VWAP again this week and continuing to form a narrow value range for the month of May. The overall range over the last 30-days has contracted considerably and building a lot of energy between 2,945 and 2,800. April’s VPOC at 2,805 remains firm support in the near-term and a number of reversal candles on Thursday helping define short-term risk/reward ranges. A move below last week’s lows at 2,766 has room down to VWAP from the March low at 2,710 and then the low-end of value from April at 2,655. A move above 2,915 has a measured target to 3,090 while the low-end of February value, and prior area of resistance, is around 3,140. Longer-term, the current bounce from the March lows continues to stall out at the 61.8% Fibonacci as well as the Sept/Oct. 2018 top and a significant volume shelf. MACD is fairly elevated given the recent move and crossed over negative last week with little follow-through so far. RSI is around 52 but did break the trend higher last week as well.

Open

Interest

Alerts

Ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Chart

Set-Ups

Saboris nisi ut aliquip ex ea commodo consequat. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequatsed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud

Market

Talk

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Flow

Recap/

Highlights

Diusmod tempor incididunt ut labore et dolore magna aliquaexercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Ut enim ad minim veniam, quis nostrud!

Weekly

market

View

The S&P 500 (SPX) pulled back off the 200-day EMA and YTD VWAP again this week and continuing to form a narrow value range for the month of May. The overall range over the last 30-days has contracted considerably and building a lot of energy between 2,945 and 2,800. April’s VPOC at 2,805 remains firm support in the near-term and a number of reversal candles on Thursday helping define short-term risk/reward ranges. A move below last week’s lows at 2,766 has room down to VWAP from the March low at 2,710 and then the low-end of value from April at 2,655. A move above 2,915 has a measured target to 3,090 while the low-end of February value, and prior area of resistance, is around 3,140. Longer-term, the current bounce from the March lows continues to stall out at the 61.8% Fibonacci as well as the Sept/Oct. 2018 top and a significant volume shelf. MACD is fairly elevated given the recent move and crossed over negative last week with little follow-through so far. RSI is around 52 but did break the trend higher last week as well.

Open

Interest

Alerts

Ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Chart

Set-Ups

Saboris nisi ut aliquip ex ea commodo consequat. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequatsed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud

Market

Talk

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Flow

Recap/

Highlights

Diusmod tempor incididunt ut labore et dolore magna aliquaexercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Ut enim ad minim veniam, quis nostrud!

OptionsHawk Mission

OptionsHawk is the premier site for active investors

We provide real time coverage of the market via options activity alerts, fundamental research, breaking news, technical set-ups and alerts, earnings strategies, sell-side commentary and much more. We provide a full suite of research and analysis to allow investors to make better informed decisions.

Our Mission

OptionsHawk is an idea generation and research platform providing accurate, unique, and high quality analysis of the equity and options market in real time. OptionsHawk aims to be the premier community for traders and investors as we simplify and maximize the efficiency of your research process while also handpicking and presenting the best ideas based on our many years of experience in a concise and timely manner.

Our Process

We integrate all methods into our process to give the most thorough assessment of a company, which includes fundamentals, technicals, institutional option and equity flows, management commentary, Macro views, catalyst discovery, and sell-side research.

Our Vision

The Hawk symbolizes the ability to use intuition and higher vision in order to complete tasks or make important decisions. Hawks also encourage you to use laser focus and precision to get things done, and to take the lead in life. The hawk represents focus, strength, and poise, and as messengers to learn powerful lessons or expand your knowledge and wisdom. The Hawk encapsulates our company vision.

Browse and Compare Options Hawk Products

Podcasts/Videos